Refreshing Snippets

August CPI Data - Why the Sell-Off?

Why would a small 0.1% increase in CPI cause such a big sell-off in the markets?

The answer: because analysts were expecting a 0.1% decline for August instead of an increase (albeit a small one at that). An increase of 0.1% indicates that inflation remains high from a year-over-year perspective (at 8.3%) and may not be moderating as hoped.

The Market Sell-Off In Perspective

Today, the Dow Jones Index fell 1,060 points ( 3.1%) and the S&P 500 index fell 3.6%. Year-to-date, the DJIA and SPX indices are down 9.2% and 13%, respectively. Investor sentiment and market commentary are extremely negative...is it time to pull out of the markets?

A Tax Lens on Retirement Investing - Asset Location

Asset location is a retirement strategy that prioritizes investing in a combination of tax-free, tax-deferred, and taxable accounts to maximize after-tax returns. The return profile of the asset and how it is taxed can make a great deal of difference to both the overall return of the portfolio over time and the amount of taxable income generated each year.

Understanding Your Investing Behavior

It’s critical that an advisor, such as Refresh Investments, understands the emotions inherent in investing, including your level of worry and your reaction to loss. To get at that, we need to look at the behavioral aspects of financial planning and investing.

Is a Target Date Fund Right for You?

Target date funds offer investors the ability to create a risk-appropriate asset allocation across multiple asset classes that automatically rebalances over time. While target date funds do have some unique attributes that can make investing for retirement on your own a little bit easier, limiting yourself to this type of investment may impact the amount of control you have in the long run.

Your Portfolio Asset Allocation - The Long and the Short of It

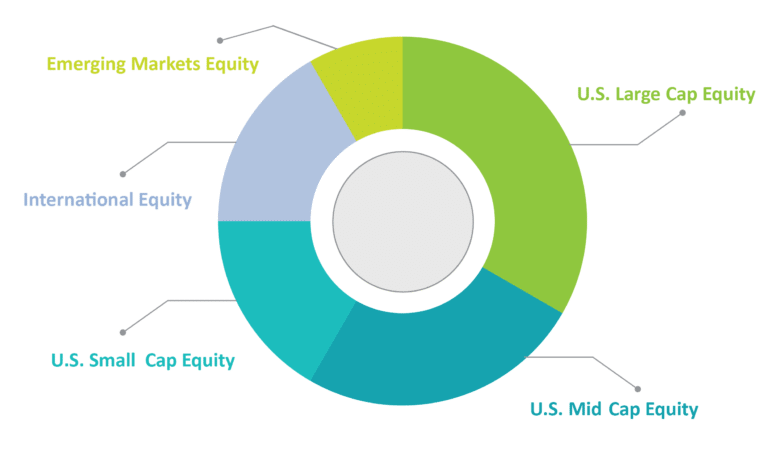

Determining your portfolio goals and your risk tolerance is the first step in creating an investment strategy. The next step is to deploy the investment strategy by mapping out an asset allocation.

Buying Bonds in Today’s Markets

When is it a good time to buy individual bonds? In today's interest rate environment, buying bond mutual funds or ETFs may be the way to go.