Refreshing Snippets

Government Debt Ceiling Deja Vu

Debt ceiling talks and ramifications for investors and the U.S. government are the top news stories of the day. Bond and stock markets have been volatile as the June 1st date deadline (when the government runs out of money) quickly approaches.

Silicon Valley Bank - What Really Happened?

The financial markets were shaken by news of Silicon Valley Bank’s (SVB) failure and the implications for other banks and the economy. Why did SVB fail and what are the implications?

Better Investing by Managing Emotions

Some believe that you can remove emotion from decision-making, but we’re human. Everyone has emotions. The important part is learning how to manage them while managing your money.

The Difference Between Trading and Investing

The key thing to remember when differentiating between trading and investing is the goal of the action. So let's take a step back and understand the differences between investing and trading and the place each of these styles has in an investment strategy.

Understanding Your Investing Behavior

It’s critical that an advisor, such as Refresh Investments, understands the emotions inherent in investing, including your level of worry and your reaction to loss. To get at that, we need to look at the behavioral aspects of financial planning and investing.

Women & Cash - Is Holding Too Much a Good Thing?

Women tend to hold more cash, but holding too much cash limits wealth growth in the long run. Wealth creation is particularly important for women as they face additional financial challenges that men generally don’t.

Is a Target Date Fund Right for You?

Target date funds offer investors the ability to create a risk-appropriate asset allocation across multiple asset classes that automatically rebalances over time. While target date funds do have some unique attributes that can make investing for retirement on your own a little bit easier, limiting yourself to this type of investment may impact the amount of control you have in the long run.

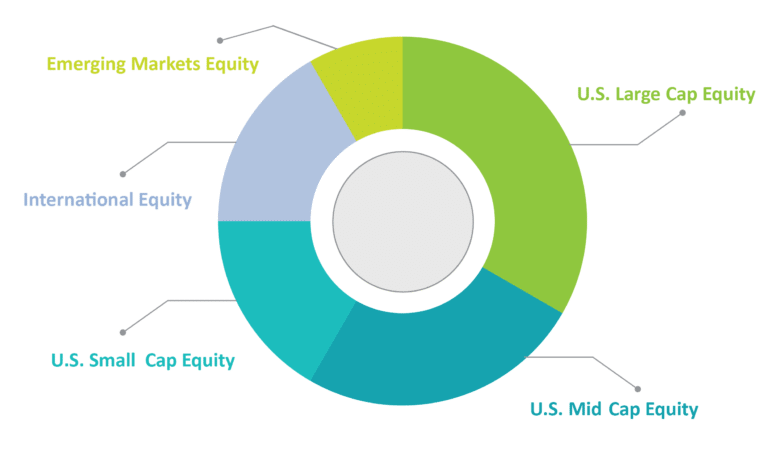

Your Portfolio Asset Allocation - The Long and the Short of It

Determining your portfolio goals and your risk tolerance is the first step in creating an investment strategy. The next step is to deploy the investment strategy by mapping out an asset allocation.

Buying Bonds in Today’s Markets

When is it a good time to buy individual bonds? In today's interest rate environment, buying bond mutual funds or ETFs may be the way to go.