Refreshing Snippets

Better Investing by Managing Emotions

Some believe that you can remove emotion from decision-making, but we’re human. Everyone has emotions. The important part is learning how to manage them while managing your money.

Determining A Stock Option Strategy

When you receive stock options, the company does not hand you shares of stock right away. Instead, you receive the right to purchase shares of company stock at a certain price, in most instances below market value.

A Tax Lens on Retirement Investing - Asset Location

Asset location is a retirement strategy that prioritizes investing in a combination of tax-free, tax-deferred, and taxable accounts to maximize after-tax returns. The return profile of the asset and how it is taxed can make a great deal of difference to both the overall return of the portfolio over time and the amount of taxable income generated each year.

Living Longer: The Importance of Planning for Long-Term Care

Since women tend to outlive their partners, building a long-term care plan is just as important as planning for retirement. For many retirees, healthcare costs are their most significant expense and without proper planning, those costs can make for a stressful retirement.

The Difference Between Trading and Investing

The key thing to remember when differentiating between trading and investing is the goal of the action. So let's take a step back and understand the differences between investing and trading and the place each of these styles has in an investment strategy.

Estate Planning: Streamlining the Transition

Planning the transition of your assets isn’t just about maximizing the amount passed on and simplifying the handover – it’s really about ensuring that the help, devotion and wisdom you provide for your loved ones now can continue even after you are gone.

Understanding Your Investing Behavior

It’s critical that an advisor, such as Refresh Investments, understands the emotions inherent in investing, including your level of worry and your reaction to loss. To get at that, we need to look at the behavioral aspects of financial planning and investing.

Your Year-End Financial Planning Checklist

Before the holiday season gears up, there are some things you should check off your list so you can keep more of what you make and have more in the future.

Women & Cash - Is Holding Too Much a Good Thing?

Women tend to hold more cash, but holding too much cash limits wealth growth in the long run. Wealth creation is particularly important for women as they face additional financial challenges that men generally don’t.

Five Things to Know About Taxes in Retirement

Many retirees assume that expenses, such as spending and taxes, will go down once they leave the workforce. However, this isn’t always the case.

Is a Target Date Fund Right for You?

Target date funds offer investors the ability to create a risk-appropriate asset allocation across multiple asset classes that automatically rebalances over time. While target date funds do have some unique attributes that can make investing for retirement on your own a little bit easier, limiting yourself to this type of investment may impact the amount of control you have in the long run.

The New Value of Advice: Women Want More

With the rise of the fiduciary, fee-only model, a new wave of service offerings and client relationships in the financial advice industry are focused on a more holistic approach – and they are available to everyone.

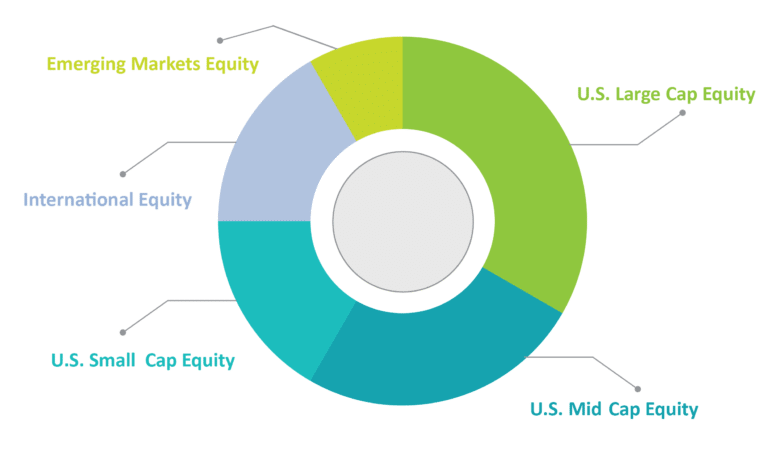

Your Portfolio Asset Allocation - The Long and the Short of It

Determining your portfolio goals and your risk tolerance is the first step in creating an investment strategy. The next step is to deploy the investment strategy by mapping out an asset allocation.

Make Your Kids Money-Smart

It’s not about how much money you have to pass on to your kids – it’s about passing on money-smarts.

How to Find the Right Financial Advisor - Free Download

It’s no secret that the financial services industry is very confusing! Many people wonder when is the right time to work with an advisor, which ones they can trust, and who is the right match for them?

7 Ways to Conquer Your Money Fears

Our passion is to help our clients conquer their money fears by meeting them right where they are in their financial journey. Below are seven suggestions for how you can conquer your money fears and start feeling more confident about your financial life.

3 Reasons Women Should Be Involved in Money Conversations

It’s a big financial mistake for women to defer investing and financial planning to their spouse or partner. Continue reading to find out why women should be part of money conversations.

Buying Bonds in Today’s Markets

When is it a good time to buy individual bonds? In today's interest rate environment, buying bond mutual funds or ETFs may be the way to go.

Are Your Finances In Order For The Next Pandemic?

Getting your finances in order can be overwhelming for some, and a task others will often put off because they just don’t have the time to address it.